Indian Ingenuity

Tailored for India,

Fueled by DataCapitalize on opportunities with

quant-driven investments.Unlock Opportunities

with QuantOffer extreme personalization, bespoke research,

tailored to Indian markets.Maximize

Risk Adjusted ReturnsMaximize returns through quantitative models, balancing

alphas and risk exposure.Tailored for India,

Fueled by DataCapitalize on opportunities with

quant-driven investments.Unlock Opportunities

with QuantOffer extreme personalization, bespoke research,

tailored to Indian markets.

Astratinvestaims for superiorrisk-adjusted returnsthrough a scientific & mathematical investment model.

We conduct quantitative research with rigorous backtesting utilizing high-quality data to identify potential outperformers.

We prioritize robust risk management framework to ensure sustained performancein Indian capital markets.

Q.

52 Dimensional Alphas

52

Q.52

52 Dimensional Alphas

Our bespoke quant models navigate India' s market intricacies adeptly

Unlike generic quantitative strategies imported from Western markets, our models are purposefully designed to capture the nuances and complexities inherent to Indian stocks and market microstructure.

Trade Execution & Risk Management

Quantitative Research & Strategy Development

Compounded Annual Growth Rate (CAGR)

Our investment approach relies on asophisticated quantitative systemthat processes vast financial data to evaluate opportunities and risks. This powerhouse integrates advanced mathematical and financial engineering techniques toidentify investmentsandmanage portfolio risksin real-time.

Our investment approach relies on asophisticated quantitative systemthat processes vast financial data to evaluate opportunities and risks. This powerhouse integrates advanced mathematical and financial engineering techniques toidentify investmentsandmanage portfolio risksin real-time.

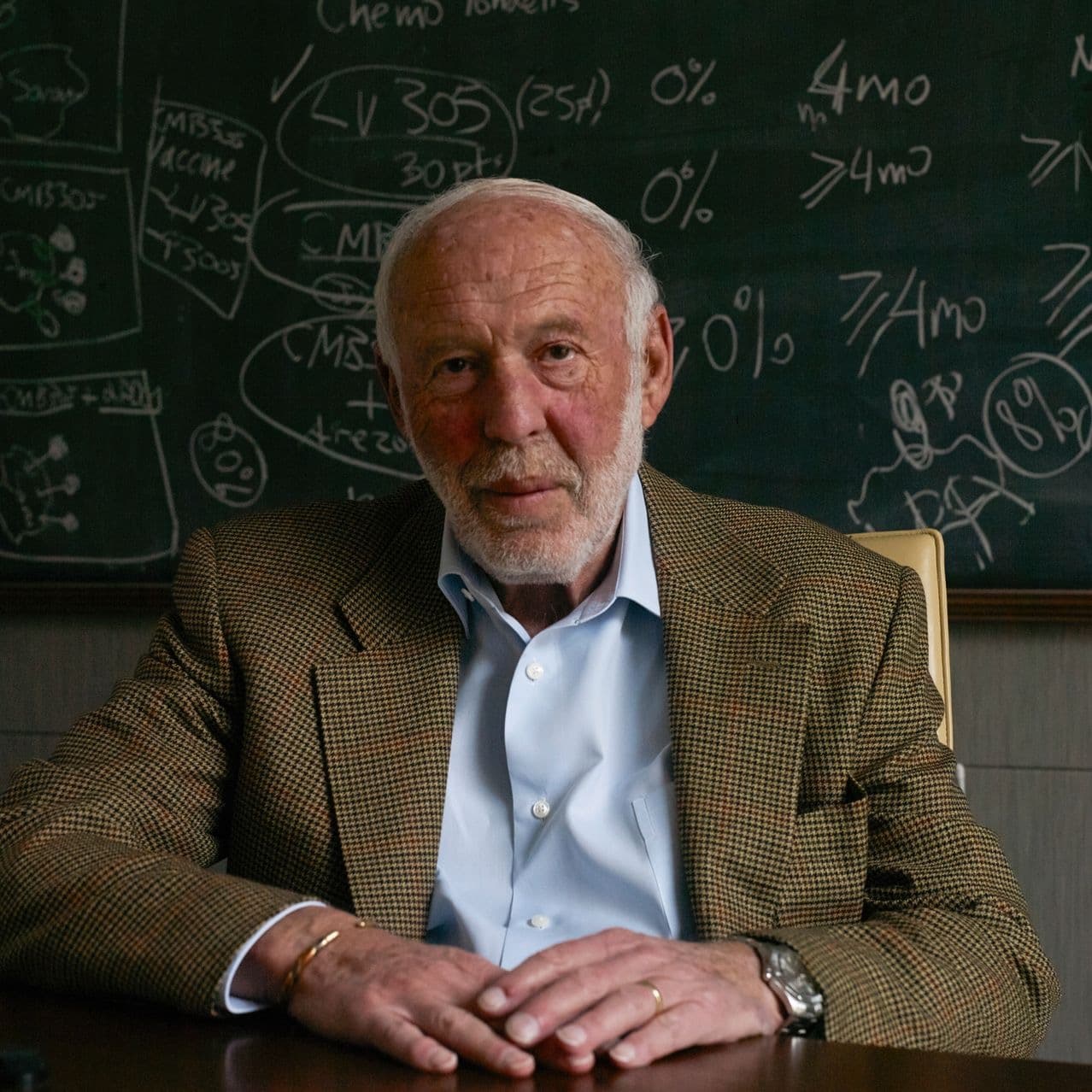

Jim Simons

The "Quant King"

"The advantage scientists bring into investing is that they have a certain rigor, a certain critical attitude, that can be very useful."

Featured on

Coverage from leading business publications

The Economic Times

The Economic Times Entrepreneur India

Entrepreneur India Entracker

Entracker Business Today

Business Today ET Edge

ET Edge News 18

News 18

TESTIMONIALS

Don't Just Take Our Word For It

Read What Others Have To Say About Us

Exploring Financial Frontiers

Register Interest in AIF

Share your details and our team will get in touch within 3 working days.